If you’re looking to sell your business but want to retain business continuity, you might be considering an employee stock ownership plan (ESOP) as a solution. While there are pros and cons, this is often a solution worth evaluating for businesses of all sizes.

Below, get answers to common questions about ESOPs that could help deepen your understanding of how they can be used as a quick and effective exit strategy for your business.

What Are ESOPs?

ESOPs allow private company owners to sell all, or a portion, of their company to their employees. This strategy quickly and effectively creates a market for the company’s stock without having to wait months or years to find a buyer.

In addition, the sale can still be structured in a way that retains employees, keeps business owners involved if they so desire, and reduces the tax burden of the transaction—all while maintaining a fair price.

How Does an ESOP Function as an Exit Strategy?

Imagine this not-so-uncommon scenario: You own part or all of a company and want to cash out by selling your ownership interest. Maybe you’re nearing retirement and the investment in your company is your biggest asset.

If it’s a private company, typically one of the biggest challenges is finding a buyer because there’s generally no market for the stock. If you also want to maintain your legacy and management team, a sale to private equity or a strategic buyer may not be an option. Your management team may also not have the funds to buy the company.

In an ESOP purchase, ownership is transferred through the creation of an employee stock ownership trust (ESOT) that may ultimately purchase the company at fair market value. A financial advisor helps owners determine the appropriate value.

Consistent with the principle of an arm’s length transaction, in which buyers and sellers act independently without one party influencing the other, guidelines established during the formation of the trust forbid it from paying more than the advisor’s stated value for the company.

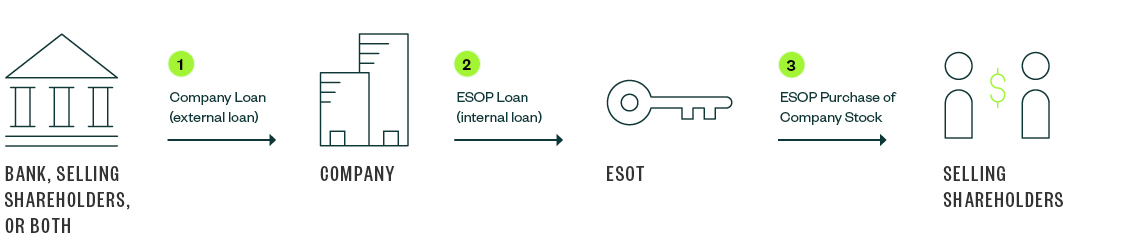

In a typical leveraged ESOP transaction, the company borrows money from the bank, selling shareholders or a combination of the two. The company then loans that money to the ESOT, and the ESOT then gives the money to the seller in exchange for the stock.

What are the Benefits of Selling to an ESOP?

Selling to an ESOP can potentially benefit everyone involved, including the seller, the company, and the employees.

ESOP Benefits for Sellers

- Create a buyer instead of finding one

- Receive a fair price

- Potentially defer capital gains tax incurred on the sale

- Continue the company’s legacy

- Retain employees

ESOP Benefits for Companies

- Deduct principal payments on the transaction from federal taxes if they’re structured as a C corporation

- Avoid paying federal taxes if structured as an S-corporation—these tax savings often fund repayment of the transaction debt

- Potential to outperform competitors because employees have a vested interest in the company’s success

ESOP Benefits for Employees

- Rewarded for long-term tenure

- Gain partial ownership of the company over time without any out-of-pocket expense

- Receive payment for their shares when they retire or leave the company

- Often receive retirement benefits that exceed those of a traditional retirement plan

For more information on the benefits of ESOPs for employees, read our article An ESOP Can Lead to More Productive, Satisfied Employees.

What Are Some Challenges of an ESOP?

While ESOPs present many opportunities, they’re also complex and aren’t always the best option for every business.

Employee Retirement Income Security Act (ERISA) Regulations

ESOPs are subject to federal ERISA regulations, which are overseen by the Department of Labor (DOL). Given their nuance and oversight, ESOPs can be difficult to structure without the guidance of advisors with extensive ESOP experience.

If the DOL audits a purchase transaction and finds the ESOT paid too much, the consequences of noncompliance can be significant and often result in an unwinding of the transaction and other monetary penalties.

Repurchase Liability

While employees benefit from the retirement fund aspect of an ESOP, companies must also be financially capable of buying back the shares from employees as they retire or leave the company. This necessity is known as a repurchase liability and must be planned for.

Additional Exit Strategy Options

There are multiple exit strategy options to weigh aside from ESOPs, each with their own benefits and pitfalls.

Finding a Buyer Through Investment Bankers

In an investment banker-assisted sale, the banker is hired to help sell a company and find prospective buyers. Generally, their fees are percentage-based and contingent on a successful sale.

Investment from Private Equity (PE) Firms

PE firms are professionally run investment companies that expect a return on their investment. They’re selective about companies in which they invest.

Sell to a Competitor

Competitors can represent an opportunity for a strategic sale because they’re often willing to pay a premium to expand their market, gain customers, or simply eliminate a competitor.

Management Buyouts

When key management buys the company they work for, it’s known as a management buyout. They individually need to have the means to buy the stock, or the ability to borrow enough to do so.

We’re Here to Help

Explore our free tools and articles for more information about other benefit plan resources as you consider your business continuity planning.

Learn more about how ESOPs can benefit business owners and employees in our article.